Welcome to GardenCities!

Welcome to GardenCities! Thank you for stopping by! We don’t take it for granted that you are taking time out of your busy day to check out our website. We are a small local real estate business in Springfield, VA. Our passion is to serve people whatever their real estate needs might be and create

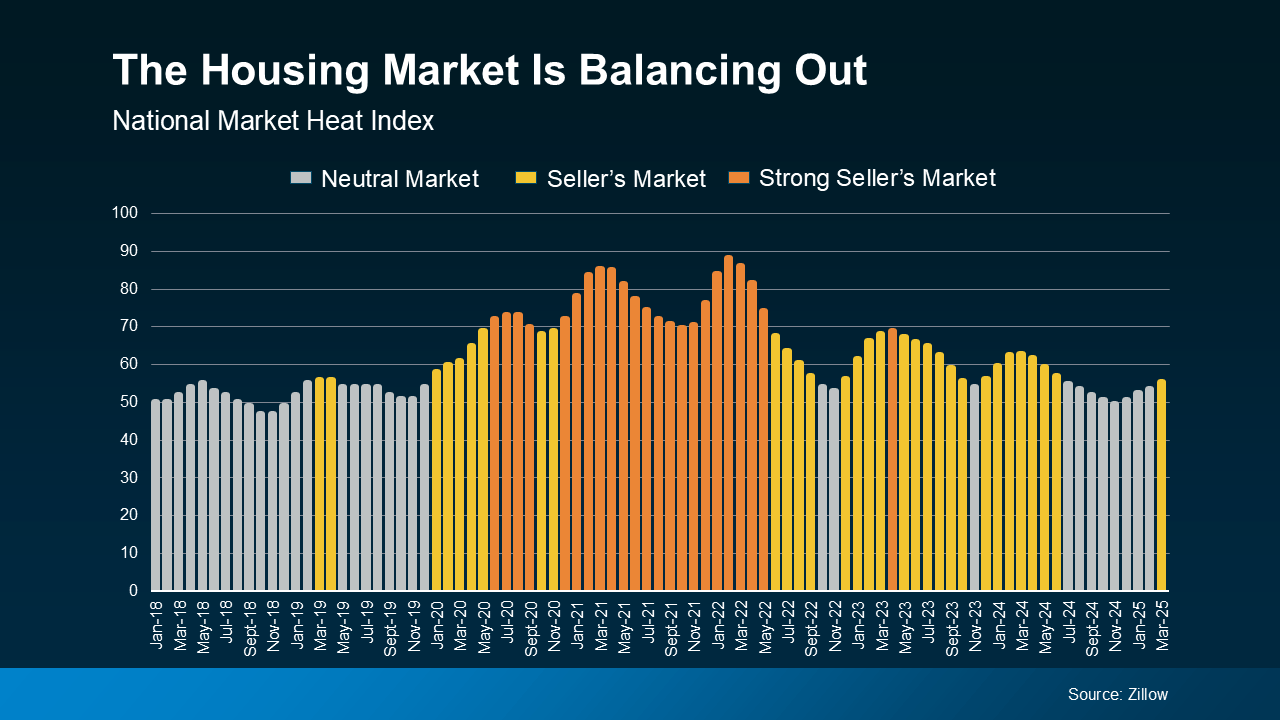

What an Economic Slowdown Could Mean for the Housing Market

Talk about the economy is all over the news, and the odds of a recession are rising this year. That’s leaving a lot of people wondering what it means for the value of their home – and their buying power. Let’s take a look at some historical data to show what’s happened in the housing market du

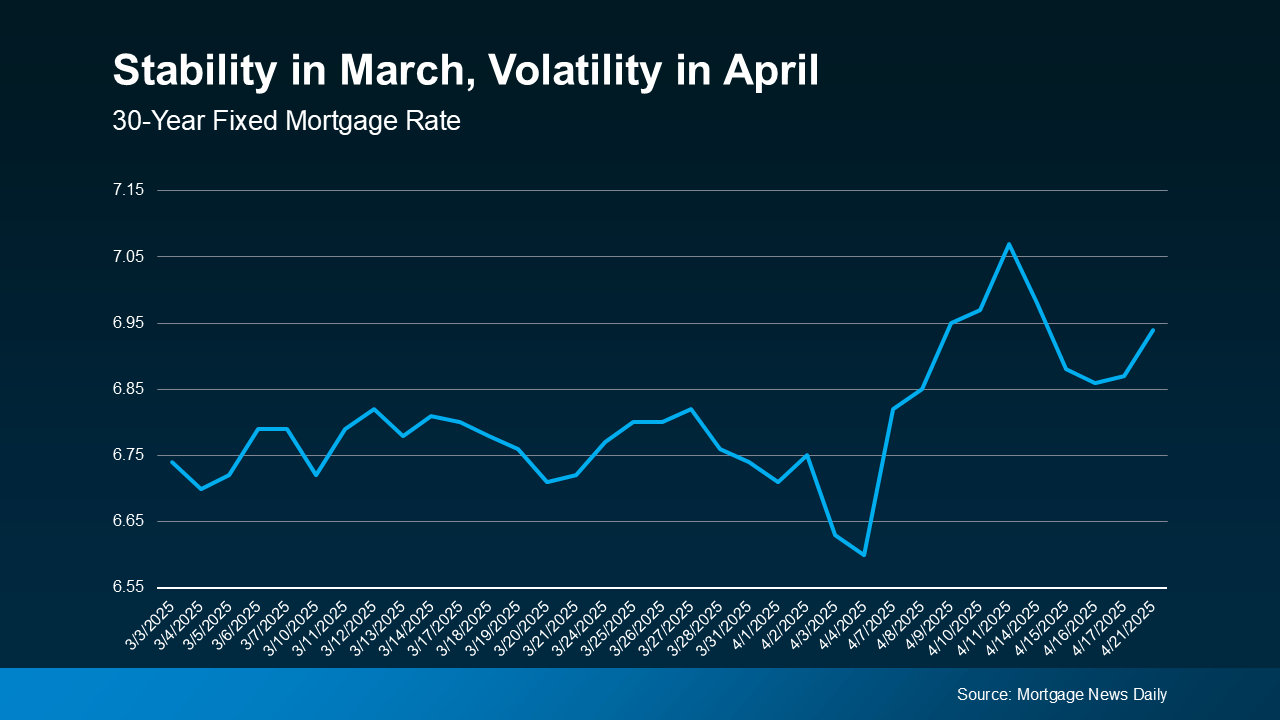

What You Can Do When Mortgage Rates Are a Moving Target

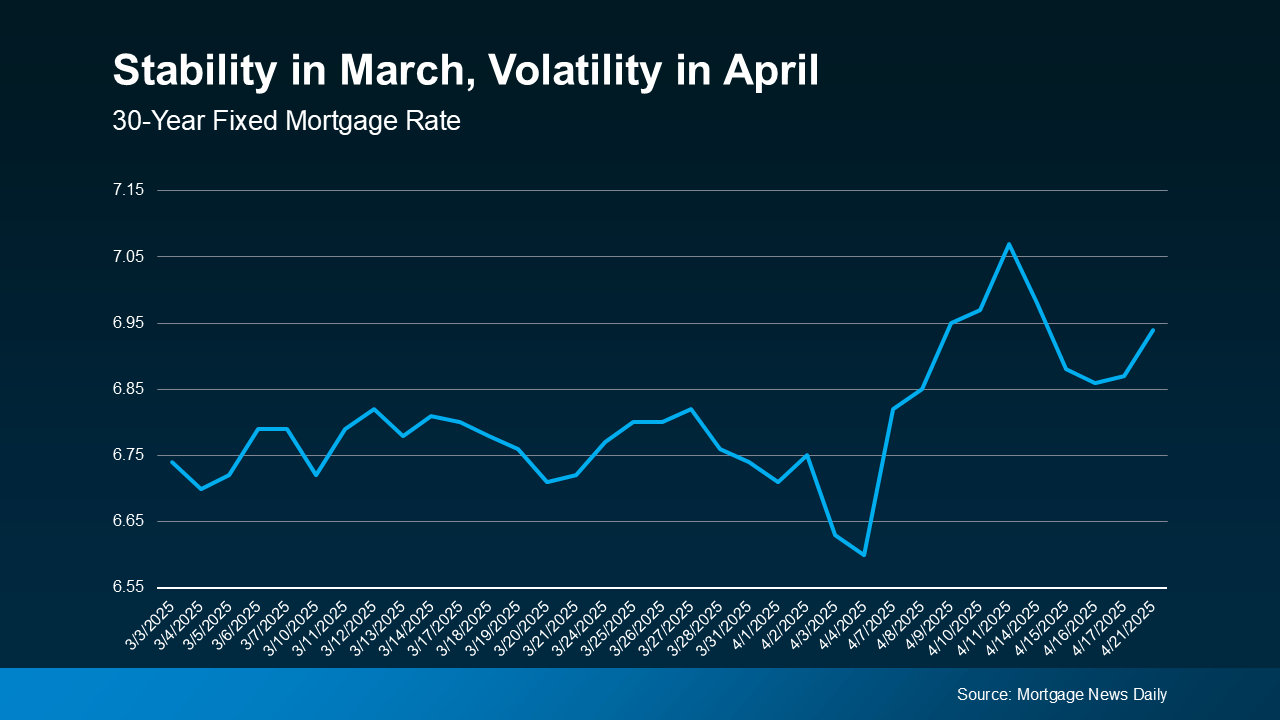

Have you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home. Take a look at the graph below. It uses data from Mortgage News D

Categories

Recent Posts