August 2024 Market Update

Below is a market update for the DC Metro Area for August 2024. Here are the five key takeaways: 1) Sales Activity in the region has slowed down, and it is, in fact, the slowest in 16 years. However, there are wide discrepancies across the region. 2) High home prices sideline some buyers. The me

July 2024 Market Update - More Contracts are Falling Through

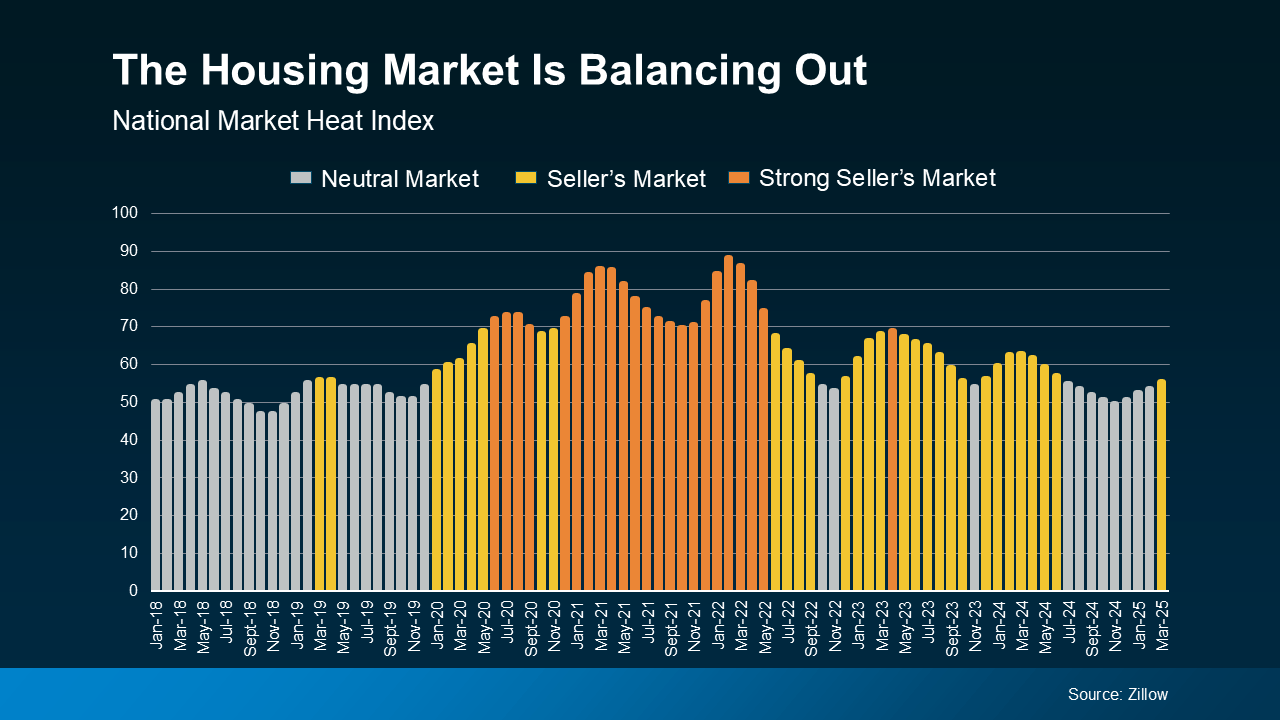

Anybody watching closely can see the signs of change in the housing market. Mortgage rates are finally coming down, and the Federal Reserve promised a further decrease in September. Inventory has steadily increased since the start of 2024, and homes are staying on the market longer. While it's stil

Categories

Recent Posts

What an Economic Slowdown Could Mean for the Housing Market

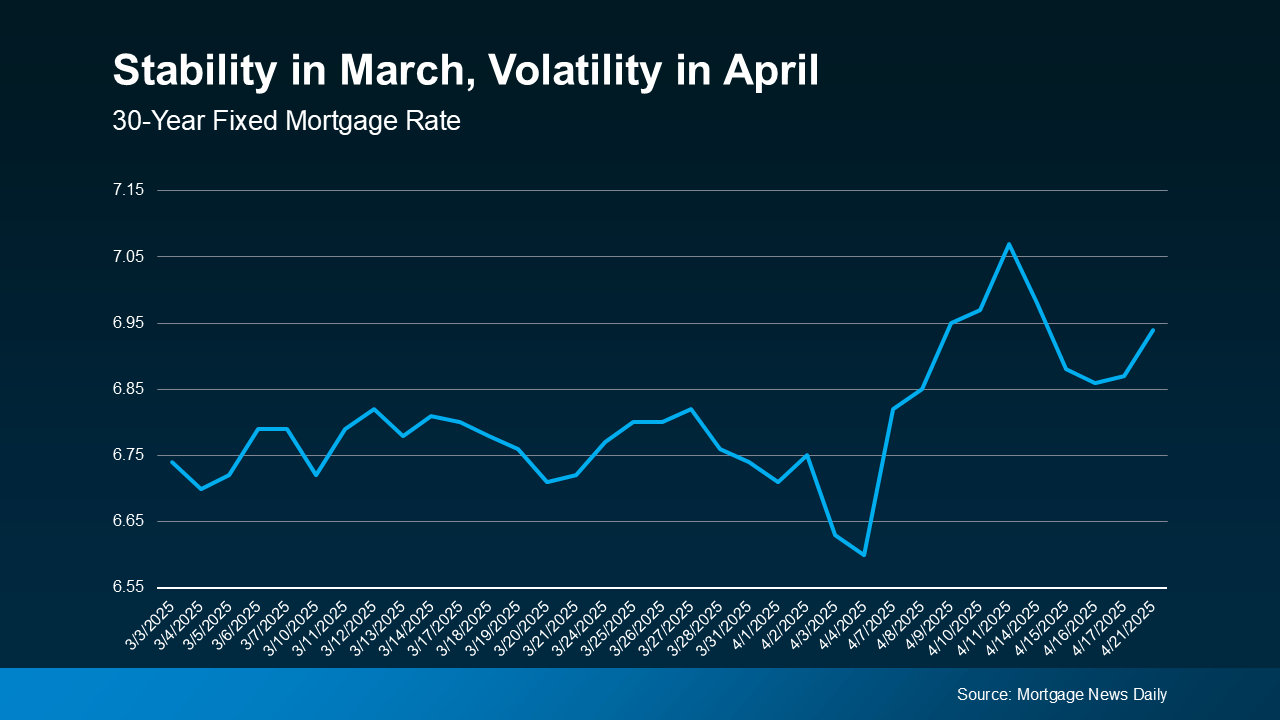

What You Can Do When Mortgage Rates Are a Moving Target

A Tale of Two Housing Markets

The Best Week To List Your House Is Almost Here – Are You Ready?

Future-Proof Designs: Home Upgrades for Longevity, Aging in Place

Fast Facts about Seniors and Downsizing

Home Price Growth Is Moderating – Here’s Why That’s Good for You

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Should You Sell Your House or Rent It Out?

The Majority of Veterans Are Unaware of a Key VA Loan Benefit